Private Investors

Grow and protect your wealth.

Create, enhance, and maintain your lifestyle.

We help create a long-term investment strategy to improve your financial future.

Families

A dedicated CFO for your family. Our team plays a part in every major financial decision that our clients and their families face. We are deeply connected to our client families and coordinate the specialists and services they need to manage their financial lives.

What you can expect:

- Private wealth management process that considers your entire net worth, from cash to real estate.

- Tax and family office resources to coordinate accounting, estate planning, insurance and other services.

- Comprehensive wealth plans that are aligned with your investment strategies and actively maintained through our hands-on client service team.

Individuals

A boutique advisory experience built for individuals. We work with individual clients to provide a wide spectrum of wealth management services. However, we believe the reason we have an exceptional client retention rate is our ability to go beyond this core offering to a premium level of client service.

What you can expect:

- Private wealth management consulting that considers your entire net worth.

- Strategic investment process that has been time-tested through multiple market cycles.

- Rigorous process to select from hundreds of independent money management firms.

- Seeking out best-in-class service providers and custodians to suit individual client needs.

- Tax and family office resources for comprehensive financial life management.

- Portfolio monitoring that incorporates quantitative and qualitative performance analysis.

- Proactive relationship management and enriching client culture.

Entrepreneurs and Business Owners

An independent wealth advisory driven by the entrepreneurial spirit. The Cooke Financial Group is a family-run business, driven by the same entrepreneurial spirit that inspires the business owners who work with us. As recognized industry leaders operating on a uniquely well-connected independent platform, we have experience dealing with complex business structures, concentrated ownership positions, and exit strategies.

What you can expect:

- Comprehensive financial guidance through all major decisions and transitions, from Initial Public Offerings to succession plans.

- Insurance, lending and liability strategies.

- Fully customized portfolio design and asset allocation process.

- In-house wealth management team and family office network to coordinate and organize your complete financial picture.

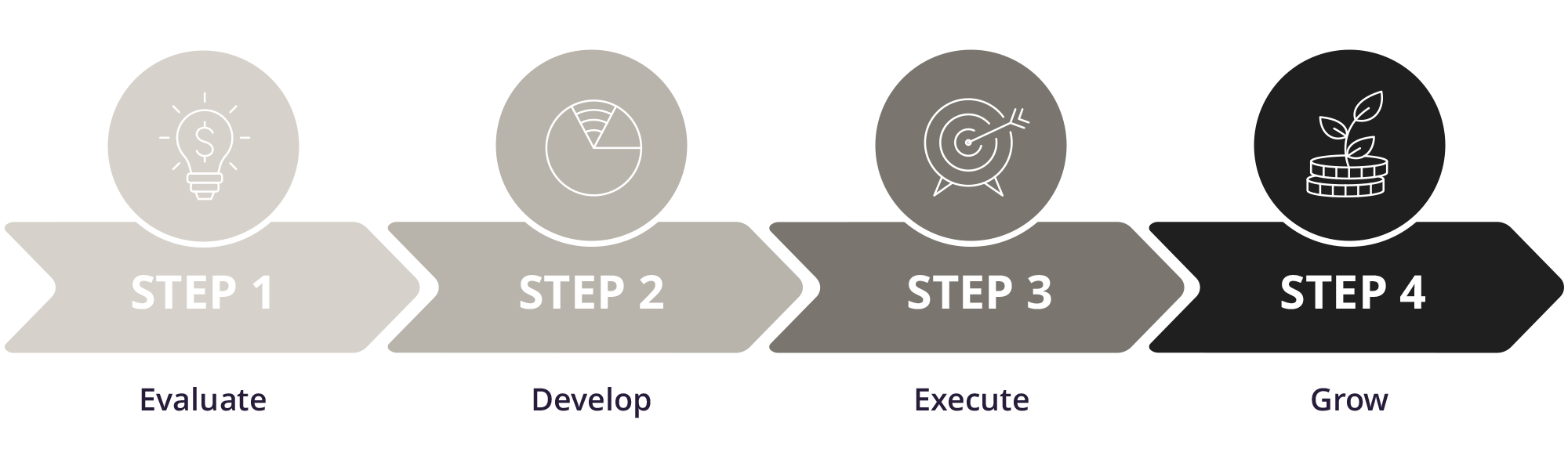

The Cooke Financial Group consulting process.

Our consulting process creates a customized investment plan that matches your financial goals and objectives.

Step 1: Evaluate Financial Goals

We work with you to uncover and understand your central goals, timelines and parameters for investing. This allows us to generate an Investment Policy Statement, which will help guide decision making going forward.

The Cooke Financial Group Difference:

When considering a portfolio transition, we are mindful of unrealized gains and losses, using tax loss harvesting to offset gains and ensure a tax-efficient transition.

Step 2: Develop Custom Investment Portfolio

Asset allocation is one of the most important factors in determining investment outcomes. Our team works to design an allocation strategy that aligns with your risk tolerance and financial goals.

The Cooke Financial Group Difference:

We go beyond the traditional 60/40 investment portfolio to deliver customized allocations to our clients.

Step 3: Execute Tailored Investment Strategy

Our managers are vetted against multiple qualitative and quantitative metrics and are reviewed on a consistent basis. Our use of passive and active external investment managers allows us to find best-in-class specialists and spend more time focusing on your wholistic financial picture.

The Cooke Financial Group Difference:

Using the Cooke Financial Group Proprietary Matrix, we follow a rigorous process to select from hundreds of independent money management firms.

Step 4: Grow and Protect Wealth

Our portfolio monitoring process incorporates quantitative and qualitative performance analysis, which allows our team to establish clear recommendations.

The Cooke Financial Group Difference:

We make changes as needed, including but not limited to: tax loss harvesting positions operating at losses to offset realized gains, swapping underperforming managers for our highest conviction managers and assessing cash needs to pinpoint opportune times to raise funds.

Personalized solutions for every step of your financial journey.

Preserve and grow your wealth with a tailored investment strategy from expert advisors.

Financial Services

| Financial Planning |

| Investment Planning |

| Wealth Management |

| Retirement Planning |

| Asset Allocation |

| Risk Management |

| Budgeting |

| Tax Minimization Strategies |

| Money Manager Selection |

| Family Office Services |

| Multigenerational Planning |

| Education/Tuition Planning |

| Corporate Retirement Plans |

| Portfolio Analysis |

| Cash Flow Management |

| Debt Management |

Concierge Services

| Business Exit Strategies |

| Concentrated Stock Positions |

| Liquidity Events |

| Philanthropic Planning |

| Lifestyle Management |

| Insurance Planning |

| Legal Coordination |

| Personalized Investment Research |

| Executive Compensation Planning |

Wealth Transfer Strategies

| Estate Planning |

| Legacy Planning |

| Family Business Succession Planning |

| Tax-Efficient Gifting Strategies |

| Charitable Giving Strategies |

| Intergenerational Wealth Transfer |

| Beneficiary Designations Review |

| Wealth Protection Strategies |

| Philanthropic Planning |

| Special Needs Planning |

| Business Transition Planning |

| ESOP Consulting |

Success stories from private clients like you.

Learn how the Cooke Financial Group delivers results for our private clients.

Retiring Executive

Client Needs:

- Executive realized a significant decline in net worth due to a decline in the value of employer's stock price. They were facing a lengthy delay in target retirement date as well as the prospect of a modest lifestyle in retirement.

- Sought investment growth and portfolio rebalancing to diversify assets and protect wealth from further downside risk.

- Wanted to find a new trusted advisor to help realize financial goals.

Cooke Financial Group Value Added:

- Portfolio was reconstructed to better aligned with the client's retirement timeline and lifestyle needs.

- Advised on how to handle stock options, including the timing and manner in which to exercise them.

- Managed their concentrated stock position and established a periodic liquidation strategy that was compliant with company and SEC policies.

Professional Athlete

Client Needs:

- Professional athlete acknowledged the unpredictability of their future income stream given the nature of professional sports and risk of injury.

- Sought advice on how to make his contract last through retirement.

- Wanted to analyze how much he could spend per year, as well as the effect of purchasing homes, cars, etc. on the likelihood of his money lasting through retirement.

Cooke Financial Group Value Added:

- Built out a Monte Carlo analysis, which helps to test an individual retirement plan's viability against a range of market environments and investment outcomes.

- Reviewed various levels of annual spend, home values, and various levels of future income to give the client better insight around his long-term financial wellbeing.

- Constructed a high growth portfolio given the client's age and maximized retirement accounts for added tax-advantage in their portfolio.

Multigenerational Family

Client Needs:

- Family with substantial net worth wanted to stretch their wealth among multiple generations and give back to the community.

- Sought to maximize the transfer of wealth to descendants and charity while minimizing taxes.

- Former advisor did not have extensive tax, trust and estate planning knowledge, and client's level of wealth required a more wholistic, family office approach.

Cooke Financial Group Value Added:

- Worked closely with the family's attorney and CPA to develop a new trust and estate plan, including both family and charitable trusts.

- Utilized annual exclusion gifts and lifetime exemption gifts to transfer wealth to the next generation tax-free.

- Positioned the parent's trusts conservatively, in line with their risk tolerance, and allocated the assets in the children's trusts for growth potential.

Locally rooted, nationally recognized.

Headquartered in Indianapolis, Indiana, our wealth advisors earn consistent recognition as some of the best in the country.

Not indicative of advisor’s future performance. Your experience may vary. Click for full award disclosures.

Chris Cooke and Brian Cooke (2018-2025): Forbes America's Top 250 Wealth Advisors, created by SHOOK Research. Most recently presented in April 2025 based on data gathered from 06/30/2023 to 06/30/2024. No fee was paid to be included in the ranking. A fee was paid to hold out in marketing materials.

Chris Cooke and Brian Cooke (2018-2025), Tammy Williams (2025): Forbes Best-In-State Wealth Advisors, created by SHOOK Research. Most recently presented in April 2025 based on data gathered from 06/30/2023 to 06/30/2024. No fee was paid to be included in the ranking. A fee was paid to hold out in marketing materials.

Tammy Williams (2025-2026): Forbes Top Women Wealth Advisors Best-In-State, created by SHOOK Research. Most recently presented in February 2026 based on data gathered from 09/30/2024 to 09/30/2025. No fee was paid to be included in the ranking or to hold out in marketing materials.

Chris Cooke and Brian Cooke (2009-2016 and 2021-2025): Barron's Top 1,200 Financial Advisors, created by Barron's. Most recently presented in March 2025 based on data provided as of 09/2024. No fee was paid to be included in the ranking. A fee was paid to hold out in marketing materials.

Chris Cooke and Brian Cooke (2025): AdvisorHub 200 Advisors to Watch (Over $1B), created by AdvisorHub. Presented in June 2025 based on data gathered from 01/2024 to 12/2024. No fee was paid to be included in the ranking or to hold out in marketing materials.

Tammy Williams (2024-2025): AdvisorHub 100 Women Advisors to Watch (2024-2025), created by AdvisorHub. Most recently presented in June 2025 based on data gathered from 01/2024 to 12/2024. No fee was paid to be included in the ranking or to hold out in marketing materials.

Tammy Williams (2024-2025): Forbes Top Next-Gen Wealth Advisors Best-In-State (2024-2025), created by SHOOK Research. Most recently presented in August 2025 based on data gathered from 03/30/2024 to 03/30/2025. No fee was paid to be included in the ranking or to hold out in marketing materials.

Cooke Financial Group (2023-2025): Forbes America's Top RIA Firms, created by SHOOK Research. Most recently presented in October 2025 based on data gathered from 03/31/2024 to 03/31/2025. No fee was paid to be included in the ranking or to hold out in marketing materials.

Chris Cooke (2024): AdvisorHub 150 Advisors to Watch (Over $1B), created by AdvisorHub. Presented in June 2024 based on data gathered from 01/2023 to 12/2023. No fee was paid to be included in the ranking or to hold out in marketing materials.

Tammy Williams (2023): AdvisorHub 100 Advisors to Watch (Over $1B), created by AdvisorHub. Presented in June 2023 based on data gathered from 01/2022 to 12/2022. No fee was paid to be included in the ranking or to hold out in marketing materials.

Brian Cooke (2022): AdvisorHub 50 Advisors to Watch (Over $1B), created by AdvisorHub. Presented in September 2022 based on data gathered from 01/2021 to 12/2021. No fee was paid to be included in the ranking or to hold out in marketing materials.

Cooke Financial Group (2022-2026): Expertise.com Best Financial Advisors in Indianapolis, created by Expertise.com. Most recently presented in January 2026 based on data gathered as of 08/2025. No fee was paid to be included in the ranking or to hold out in marketing materials. Additional fee was paid for advertising.

Chris Cooke, Brian Cooke, Lisa Grimes, and Kevin McCurdy (2012-2016 and 2018-2025), Tammy Williams (2022-2025): Five Star Professional Five Star Wealth Manager Award, created by Five Star Professional. Most recently presented in September 2025 based on data gathered from 11/2024 to 05/2025. No fee was paid to be included in the ranking or to hold out in marketing materials.

Connect with Cooke Financial Group.

Reach out to our award winning team and let us know how we can help. We'd love to have the opportunity to serve you. We look forward to hearing from you.

Office Hours:

Monday - Friday 8:00 AM - 5:00 PM EST

9340 Priority Way West Drive Indianapolis, IN 46240

(317) 814-7800

contactcooke@cookefg.com

Follow Us on Social: